Global AI Server Market Surges to $50 Billion in 2023, Expected to Exceed 50% Share by 2027

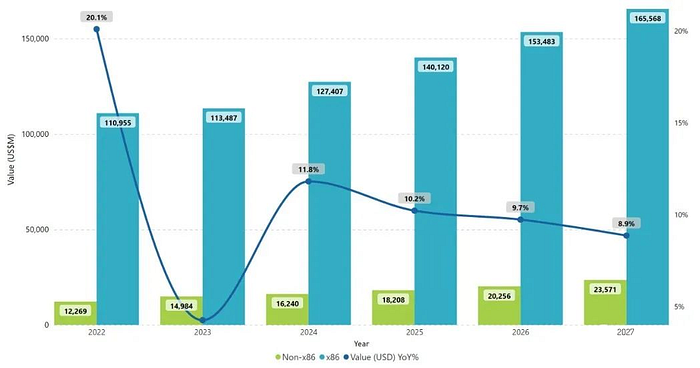

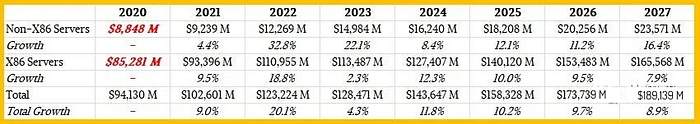

Recently, market research organization IDC released its latest research report on the global server market. The report indicates that in 2022, the global server market size experienced a year-on-year growth of 20.1%, reaching $123.224 billion. It is anticipated that the market size will see a slight increase to $128.471 billion in 2023. The annual growth rates for the following four years are estimated to be 11.8%, 10.2%, 9.7%, and 8.9%, respectively. By 2027, the market size is projected to reach $189.139 billion.

Specifically, in 2022, global x86 server sales amounted to $110.955 billion, marking an 18.8% year-on-year increase. In contrast, non-x86 server sales surged by 32.8% year-on-year to $12.269 billion. In 2023, the growth in the global server market slowed down, with x86 server sales experiencing a mere 2.3% year-on-year increase to $110.955 billion. However, non-x86 server sales maintained a high year-on-year growth of 22.1%, reaching $14.984 billion. According to IDC’s projections, by 2027, x86 server sales will escalate to $165.568 billion, while non-x86 server sales will also increase to $23.571 billion.

Looking at the broad pattern, although non-x86 servers have sustained continuous rapid growth over the coming years, x86 servers remain the mainstream in the server market, maintaining a sales-based share of over 87.5%. Even by 2027, the market share of non-x86 servers will still be slightly under 12.5%, barely up from 11.66% in 2023, an increase of less than 1 percentage point.

However, significant shifts are occurring within the non-x86 server market segment. Over the past decade, around half of the non-x86 servers were comprised of IBM’s Power Systems and System z mainframes, with the rest being a combination of other proprietary servers and Arm servers. But with the rise of Arm servers among hyperscale vendors and cloud builders, the portion led by Arm in the non-x86 server segment is growing. Furthermore, with the emergence of RISC-V servers, this market segment is expected to undergo further changes.

Another dataset from IDC reveals that in 2020, IBM’s System z and Power revenues amounted to $4.98 billion. This suggests that in 2020, non-x86 server product sales, including Arm servers and other processor architectures, totaled $3.87 billion. Assuming certain scenarios for future IBM products, such as the upgrade cycles for Power10 and z16 machines in 2021 and 2022, and Power11 and z17 machines in 2025, it’s possible to anticipate a gradual decline in IBM server hardware sales from slightly below $5 billion in 2020 to $3.5 billion in 2026, potentially reaching $3.3 billion by 2027. Based on IDC’s data, other types of servers within the non-x86 segment, like Arm/RISC-V, are expected to grow at a robust pace, subject to investment cycles of hyperscale enterprises and cloud builders, maintaining a benchmark level. Inevitably, if adoption occurs, the annual sales of Arm and RISC-V servers (mostly Arm servers) could reach around $20 billion.

Moreover, due to numerous hyperscale enterprises and cloud builders focusing on customizing Arm server CPUs and AI coprocessors, there’s a wide range of choices available. This trend faces pressure not only from using X86 server CPUs and Nvidia GPUs for AI and other compute-intensive workloads but also from the widespread adoption of customized Arm servers.

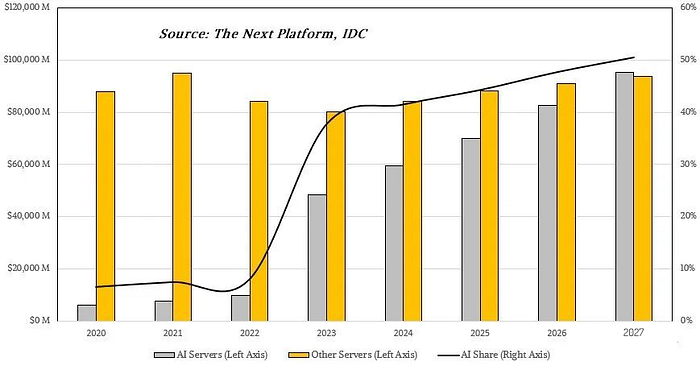

Considering this, how AI server sales (primarily for training but also for inference) differ from sales of other types of servers?

IDC mentioned in its report: “In each subsequent quarter of 2022, inflation had a stronger direct impact on servers, with the average selling price (ASP) year-on-year growth rate rising to 29% in the second quarter of 2023, while server shipments mostly hovered around low double-digit year-on-year growth for most of 2022 but declined by 1.4% year-on-year in the fourth quarter of 2022 and by 10% in the first quarter of 2023, and now in the second quarter of 2023, it has again fallen by 19.9% year-on-year.”

Compared to the significant decrease in shipment volumes, the continuous rise in average selling price is primarily driven by very expensive AI training and inference nodes (each node costing hundreds of thousands of dollars with four or eight GPUs). AI servers and non-AI servers indeed need to be segregated as they represent very distinct segments in the market. Therefore, The Next Platform, based on IDC’s revenue forecast for servers from 2020 to 2027 (IDC data indicates the global AI server market size was $11.2 billion in 2021), attempted to classify them as follows:

The Next Platform believes that unless something slows down the growth of AI models or makes AI training and inference computations cheaper, it’s reasonable to expect that by 2026 or 2027, AI servers will account for approximately half of the entire server market revenue.

The model assumes a steep decline in non-AI server revenue by 11.2% starting in 2022, followed by moderate growth similar to GDP every year. By 2023, this situation is expected to improve, with only a 5% decline. Between 2022 and 2023, AI server revenue will experience an astonishing nearly fivefold leap, reaching around $50 billion in the global AI server market size by 2023. Subsequently, there will be a healthy and stable growth of around 20% in 2024, tapering off to 15% by 2027. According to this predictive model, AI server sales will surpass traditional server sales by 2027.

Currently, AI applications are experiencing explosive growth. With the increase in Nvidia GPU supply and price reductions, as well as the entry of GPUs from other brands and other types of AI accelerators gaining traction in the market, everything is expected to stabilize and normalize, possibly reaching an entirely new level.

One question remains: how much supply does the world’s AI need? Predicting the situation four or five years down the line is indeed very challenging. If the demand for AI accelerators continues to outpace supply, and prices remain high, revenue will stay elevated. If production doubles or triples and prices decrease by half or two-thirds, then revenue might stay unchanged.

Clearly, no manufacturer would want to lower profit margins through excessive sales, but intense competition might force companies into that position.

From 1985 to 2000, it took fifteen years for RISC/Unix machines and internet technology to capture a 45% share of server market revenue through active upgrades in mainframes and proprietary small-scale machines. It might take a similar fifteen-year span — from 2010 to 2025, or from 2011 to 2026 — for AI servers to account for around 45% of global server revenue, with AI workloads replacing or expanding into various applications you can imagine.