Debunking the Low Entry Barrier Myth in the Optical Module Industry

“Any network engineer who has never encountered the various pitfalls of optical modules/DAC/AOC is certainly not a true network engineer.” Believe me, no one would disagree with this statement. Even the most demanding clients cannot fully eliminate the various problems that can arise due to optical modules/DAC/AOC. This is why many clients, when procuring these network components, would rather pay a higher price to get the original manufacturer’s products. However, even so, it’s still unavoidable to run into issues.

Moreover, the failures encountered by everyone are varied. Some common ones include: ports not coming up, link flapping, a high number of CRC errors, packet loss, optical modules burning out, optical modules going down during operation, packet loss occurring during operation, and so on. The list goes on and on…

China boasts a plethora of optical module manufacturers, a fact that may surprise many. However, it’s important to note that over 90% of these companies are small-scale enterprises, with some even resembling small workshops. This begs the question: Is the barrier to entry in this industry truly as low as it seems? In this article, we aim to shed light on this intriguing topic.

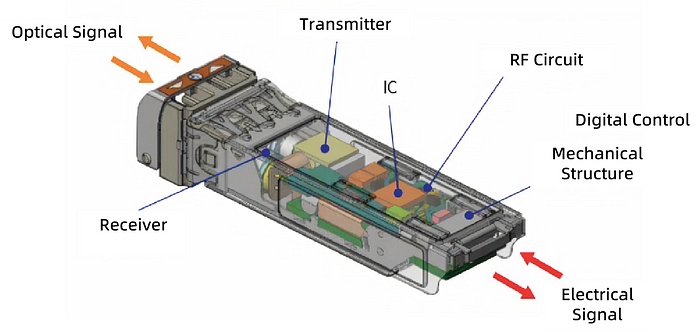

As depicted in the diagram, optical modules comprise several core components. Among these, the transmitter and receiver collectively form the optical transceiver, with the laser being the most pivotal element. Additionally, there are detectors, amplifiers, and IC designs housing MCU control chips running driver programs. Notably, the laser stands out as the most critical and cost-intensive component in optical modules, boasting the highest technological complexity. Generally, the more advanced the optical module product, the greater the proportion of costs attributed to lasers in the overall cost structure. Beyond these, we encounter filters, gold fingers, PCB circuit boards, capacitors, resistors, inductors, EEPROMs, structural components, and hidden elements like solder and adhesives.

Globally, there exists a plethora of manufacturers capable of producing optical modules/AOC/DAC. However, it’s crucial to recognize that all these manufacturers largely rely on a limited pool of suppliers for lasers and MCU chips, primarily sourced from overseas. While some domestic manufacturers are proficient in handling lower-end products, high-end products predominantly hail from foreign suppliers.

So, why is the barrier to entry into the optical module/AOC/DAC industry perceived as low?

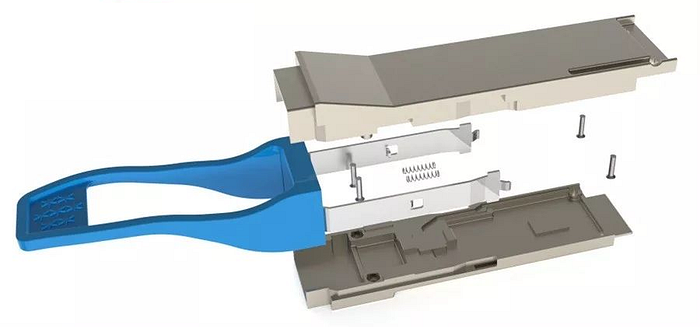

For the majority of mature products, the barrier is indeed relatively low in this domain, giving rise to numerous small-scale workshops where a mere few dozen individuals can initiate an optical module venture. The rationale behind this low barrier lies in the fact that optical modules/AOC/DAC are essentially considered pure hardware products. While MCU controllers execute drivers, these are comparatively straightforward, standardized components (although variations exist between manufacturers, leading to compatibility challenges). The core components utilized in these hardware products are readily accessible to all, and manufacturers can easily access reference hardware solutions from prominent suppliers, sometimes even providing pre-assembled boards to downstream manufacturers. For module manufacturers, this implies that many mature products share highly similar technology solutions, with limited technical barriers. This sharply contrasts with switches, where disparities in board design and intricate software systems result in substantial discrepancies in quality and capabilities, despite all switch manufacturers having access to CPUs and switch chips of identical quality.

Where do these disparities originate?

In theory, given standardized specifications and low entry barriers, one might assume minimal differences between module manufacturers. However, reality presents a different picture. Myriad compatibility issues arise between different modules and devices, and even modules of identical type and model from the same manufacturer can exhibit variances when deployed on different devices. Several factors contribute to these disparities, but, in essence, they can be attributed to discrepancies in engineering and supply quality.

- PCB quality

- Quality of selected capacitors and resistors

- Dimensions of gold fingers (length, width, thickness)

- Quality of solder

- Quality of adhesive

- Variations in product design, cost, heat resistance, and high-temperature endurance among different manufacturers

- Differences in production testing equipment, the quantity and variety of equipment, automation level, and the availability of third-party equipment like switches/servers and network cards, all leading to variations in product quality and compatibility.

- Differences in R&D capabilities and quality control capabilities among different manufacturers.

- Variances in the quality of upstream electronic components received by different manufacturers. Generally, larger manufacturers receive higher-quality upstream electronic components.

In summary, while the core chips in optical modules may be mature, substantial disparities exist between modules from different manufacturers. Procuring low-quality modules can lead to a range of peculiar problems, as previously listed.

Furthermore, with market demands evolving swiftly, the research and development of optical modules must continually keep pace. For instance, there is a growing market demand for enhanced cooling of high-speed optical modules, accompanied by a reduction in module size. These factors place greater demands on optical module technology.

In conclusion, while the technology barrier in the optical module industry does indeed exist, it is not exceedingly high. Looking ahead, as market demands continue to evolve, and technology advances, the technology barrier for optical modules is expected to elevate.

As exemplified by some high-end products, there are still relatively few global manufacturers capable of producing them. For instance, in the realm of high-speed optical modules, GIGALIGHT has already achieved rates of 400G and 800G. Moreover, even with identical products, such as 100G single-mode modules, while most manufacturers can only reach a few kilometers, GIGALIGHT can stretch that distance to 90 kilometers. GIGALIGHT is also at the forefront of promoting cutting-edge technology products such as silicon photonics, liquid cooling, and coherent solutions.